Feline Lim/Getty Illustrations or photos Information

I have to acknowledge I have been overly bearish on Apple (NASDAQ:AAPL) the earlier number of yrs. I threw the business in the exact overvalued boat as other large tech names. Of study course, most mega-cap technological know-how giants have fallen, and many have crashed due to the fact Oct. Additional, I have fretted about its provide chain focused in China and the rest of Asia through the COVID-19 pandemic. I am completely nervous about its Taiwan producing subcontractors, as China’s rhetoric about getting about the island by armed service power has grown louder and louder.

However, the stock quotation keeps drifting better, and working effects have been stable. Customers just can not get more than enough Apple merchandise. For instance, my daughter is getting completely ready for college or university in the fall, and she has demanded a new Iphone, iPad and MacBook Pro laptop. It is really hard to say no, with her earning plenty of scholarships and functioning a large spending summer months work. She even persuaded me to upgrade to an Apple iphone past year, from my responsible aged-fashioned, inexpensive-ass flip phone. [Yes, I do not know how to use it very well. Still learning how to take pictures and text with hieroglyphics, called emojis nowadays. I did figure out how to go to Seeking Alpha and check my quotes on the run.]

I digress. My position is Apple proceeds to outperform expectations and the U.S. stock sector. Warren Buffett’s first 2016 entry level when it was throwing off 8% in absolutely free dollars movement generate (following stripping out its significant income stash back then) and developing 20-25% on a yearly basis has demonstrated a stroke of genius. However for Berkshire Hathaway (BRK.A) (BRK.B), most of his other picks the earlier five several years have been average to unsatisfactory for performance as a team. I specially disagree with his newest Occidental Petroleum (OXY) purchase, which I mentioned in a bearish article for the duration of early March in this article.

Here’s the bottom line: if you imagine like I do that stock price ranges discounted organization success 3-6 months into the potential, Apple’s Q1 quantities out this 7 days need to be shut to anticipations. The massive wildcard will be direction for the relaxation of the year, as customer spending is slowing fast and China is embroiled in pandemic shutdowns all over again in March and April. A lot less demand by consumers and less item obtainable to market may well stimulate the company to mood expectations for advancement.

Bearish Prolonged Valuation

The knock in opposition to Apple remains a tremendous-abundant valuation that appears to be to completely selling price in impressive progress by now. Big Tech’s difficulty in late 2021 and early 2022 is shares had been/are discounting a greatest-of-all-worlds set up of substantial desire and small inflation/curiosity fees. When expansion rates faltered and inflation skyrocketed, a major dinger for price tag was inevitable. I have mentioned the priced-for-perfection trouble for Large Tech in tale soon after story on Looking for Alpha considering the fact that final summertime, contacting out NVIDIA (NVDA), PayPal (PYPL), Microsoft (MSFT), Adobe (ADBE), Ark Innovation ETF (ARKK), and a host of some others if you scroll down the titles I have written underneath my name.

Apple has been a section of this group. I have shied away from possessing or recommending AAPL, all a functionality of its valuation vs. climbing interest charges. The odds also favor an eventual hiccup in its Asia provide chain and/or a economic downturn in U.S. need for electronics as desire charges squeeze purchaser self esteem, disposable income and paying in the serious economy. So, I determine Apple’s upside remains incredibly minimal.

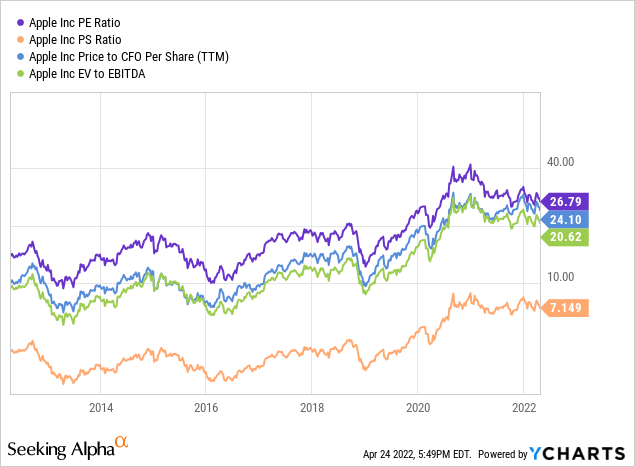

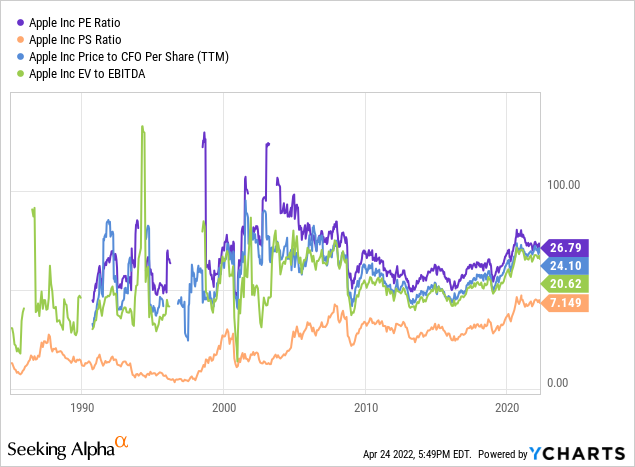

Down below are graphs highlighting valuations on earnings, product sales, funds movement, and EBITDA approaching 10-year highs. On value to trailing 12-month calculations, there are literally hundreds of significant caps, and thousands of smaller sized caps with superior upfront truly worth on the identical valuation ratios. The 2nd chart seems to be again to 1986, a couple decades right after its IPO in 1980, to review main swings up and down in valuation based on firm advancement anticipations, working results, curiosity charges, and buyer shelling out wellbeing.

Apple 10-Yrs, YCharts Apple 1986-2022, YCharts

Continuous Specialized Momentum Gains

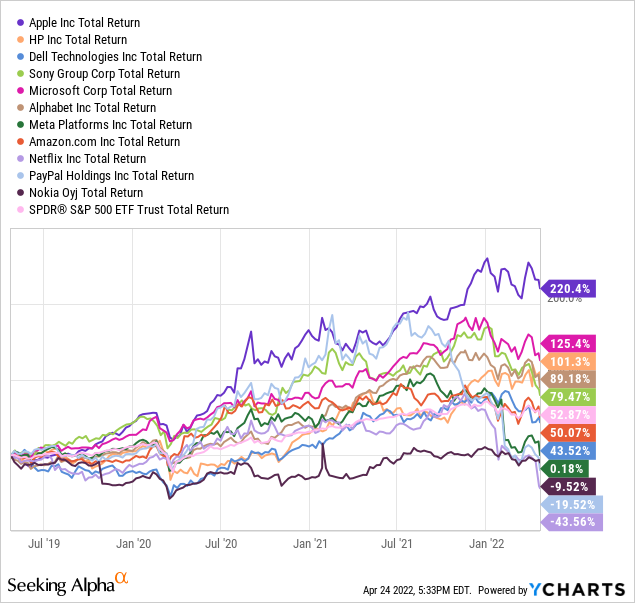

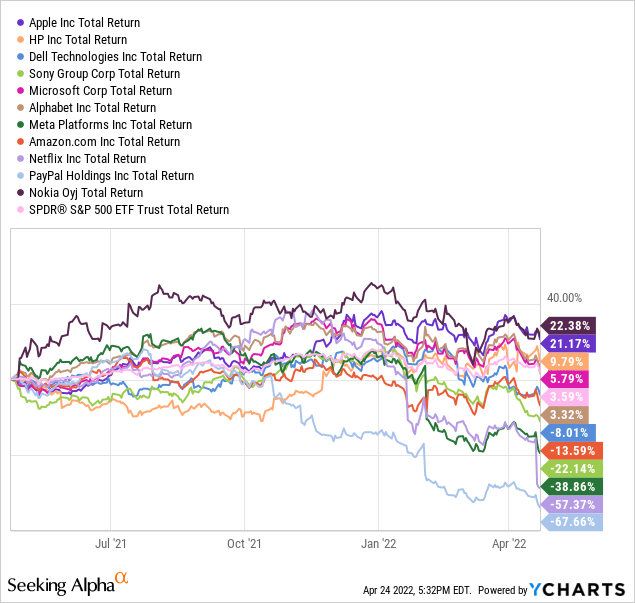

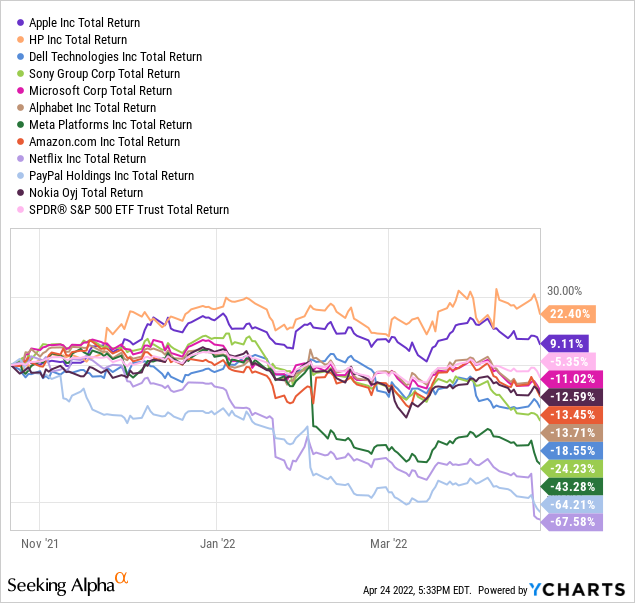

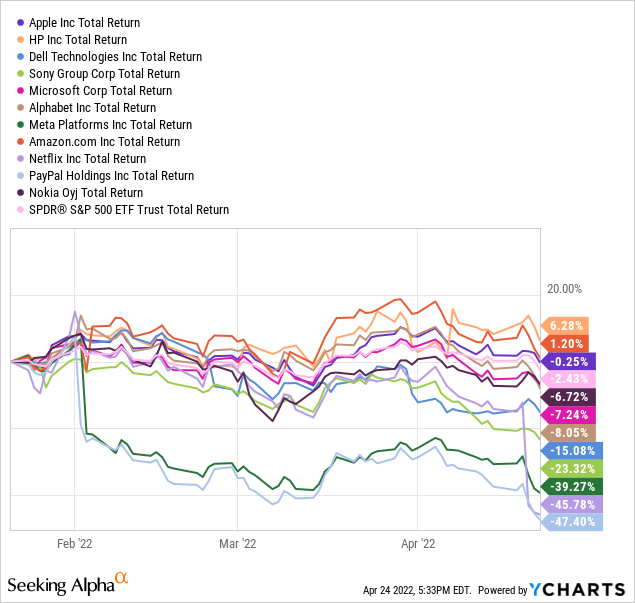

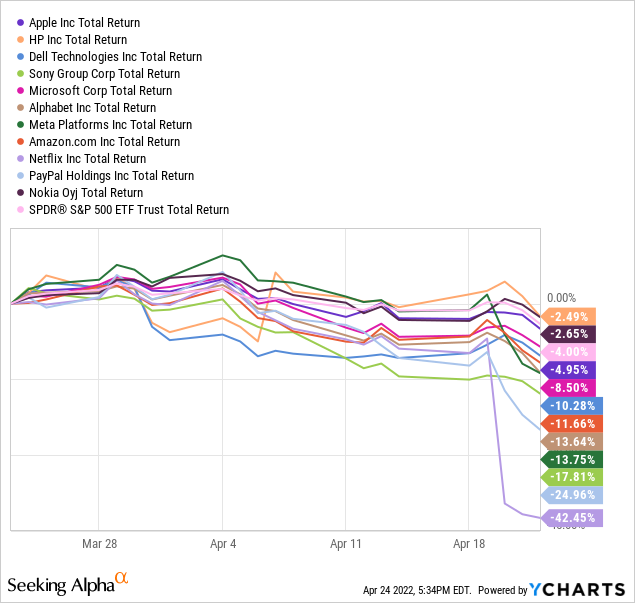

The bullish aspect of the expenditure equation is consumers continue to keep piling into Apple shares every day and weekly. This identify has outlined the ideal whole return more than the past three several years, such as dividends, of the couple of really serious friends in the Huge Tech hardware, software package, economic transaction and enjoyment conglomeration fields. Over other comparison periods, from 1-month to 1-year, Apple has tested an similarly favourable investment to keep, scoring appropriate near the top of each individual kind period of time. In addition, Apple has soundly overwhelmed the S&P 500 index overall return in excess of each individual span, exterior of the final four weeks.

3-Yrs, YCharts 1-Calendar year, YCharts 6-Months, YCharts 3-Months, YCharts 1-Thirty day period, YCharts

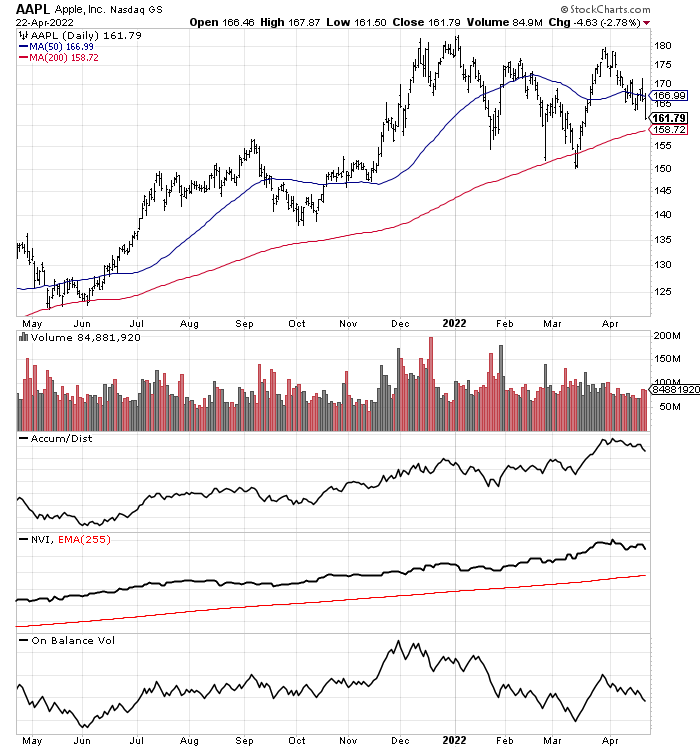

The broad the greater part of momentum indicators I comply with continue being neutral to bullish on Apple currently. The main standout adverse is On Harmony Volume has not manufactured material progress in decades. I have drawn a 12-thirty day period chart underneath of everyday cost and volume alterations with a handful of momentum calculations, like OBV. On the good aspect for investors, the Accumulation/Distribution Line and Negative Quantity Index have stayed tremendous-sturdy, like they have for many years running.

12-Thirty day period Chart, Each day Values – StockCharts.com

Final Ideas

At this stage, you can coloration me amazed with regards to the stock’s skill to maintain onto gains. If Apple can supply final results all around Wall Street analyst estimates and tutorial near to latest anticipations for the rest of 2022, I anticipate the share value to keep on being higher than $150, the reduced trade in March.

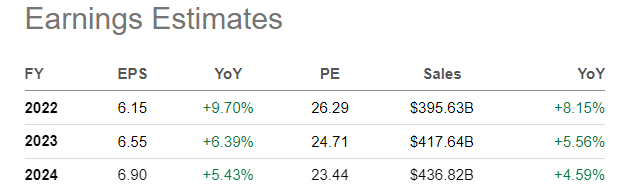

Trying to get Alpha Table – Analyst Consensus Estimates – April 24, 2022

Reviewing progress projections for the two product sales and EPS in the one-digit range yearly for 2022-24, investors appear to be information with Apple’s diversified gadget, cloud, software, and entertainment portfolio of organizations with the fruity model name. A high quality valuation to the U.S. equity marketplace averages sure, but not an insanely too much setup.

When I evaluate all the pros and negatives, I am upgrading my score for Apple from a Market to Maintain. I really do not anticipate a monster down shift in 2022, following other illustrations in the Big Tech house. Still, I am however skeptical of the upside tale, as every thing will have to participate in out in a bullish way to get to $200 a share this 12 months or upcoming. What we may well witness is a buying and selling assortment for the stock amongst $140 and $180 more than the following 12-18 months. A flat quote alongside even small enlargement in the fundamental working organization would assistance the valuation dilemma, and likely prepare its value to transfer higher than $200 by late 2023 or early 2024. In the close, bulls and bears hoping for radical swings may both of those find themselves dissatisfied.

The most vital danger, outdoors of management’s control, is the Chinese source chain. I will be listening for clues in this week’s convention phone about the affect of COVID lockdowns in Shanghai and other areas of the financial powerhouse that is China. Spiking curiosity premiums would be my 2nd worry, just mainly because satisfactory expense returns are being strike every day with their relentless increase in early 2022. The very good information for Apple investors is the enterprise doesn’t truly borrow money, so greater curiosity cost has an effect on rivals far more. In reality, climbing inflation fees may well be a internet favourable if rate will increase do not drastically dent client desire. Mr. Buffett has mentioned frequently he thinks Apple merchandise are “underpriced,” giving administration plenty of wiggle place to ward off expense pressures possibly from commodities or labor.

I do not very own a position in Apple these days, and imagine new shopping for money really should look for in other places for better valuations and expansion premiums. Apple’s approximately $3 trillion market place capitalization is a file for any American enterprise. Rapid advancement off a large base quantity is next to unachievable in an overall economy witnessing a slowdown.

Many thanks for reading through. Remember to think about this write-up a initial stage in your owing diligence process. Consulting with a registered and professional financial investment advisor is advisable prior to building any trade.