PhonlamaiPhoto/iStock via Getty Images

Investment Thesis

Micron Technology (NASDAQ:MU) is an industry leading semiconductor memory and storage company. They develop, manufacture, and distribute high performance DRAM, NAND, and NOR memory chips. Thanks to their technological superiority and efficiency, they hold a substantial market share across various semiconductor sectors, and have been generating an impressive operating cash flow. Also, Micron’s revenue has outpaced the overall industry over the past several years. The recent marketplace volatility has hit tech and growth stocks particularly hard, lowering the prices on some great companies, including Micron Technology. I believe Micron Technology is a great investment because:

- Their impressive growth trajectory is multifaceted. Growth from the data centers, automotive market, and PC will continue for the foreseeable future.

- Industry leading technology and efficiency provide a substantial economic moat and generous profit margins.

- Micron’s financial strength is far above the industry average. This strong financial position will enable them to maintain a competitive edge through aggressive investment and acquisitions.

Multifaceted Growth Trajectory

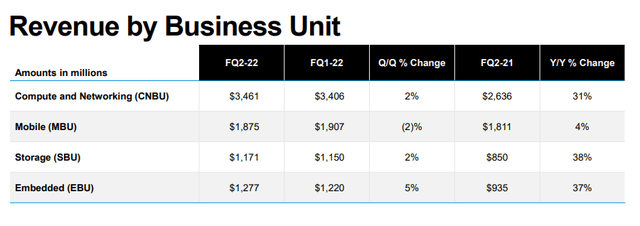

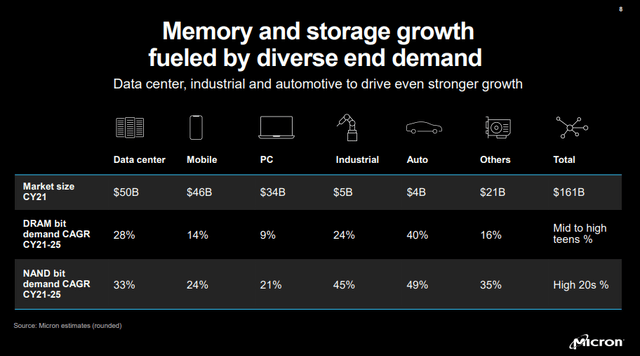

We all know that demand for semiconductors is just going to keep increasing, since almost anything and everything in our lives contain semiconductors. Reflecting this favorable macro trend, Micron’s growth trajectory has been multifaceted across data center, PC, Graphics, Mobile, Automotive, and Industrials segments. In particular, the revenue growth from the data center segment has been exceptional (60% YoY). In 2021, data centers became the largest market for memory and storage, surpassing the mobile market, and this trend will likely continue in the foreseeable future.

Additionally, the automotive and industrial spaces are expected to be the fastest growing segments over the next decade, and Micron is well positioned to capture the leading position in terms of market share. During the last earnings call, management mentioned that new electric vehicles are like a data center on wheels, requiring 15x higher memory and storage content than the average car. Meanwhile, factory automation and security systems are the main drivers of growth in the industrial segment.

The ongoing transition from 4G to 5G will positively contribute to Micron’s revenue growth as well. 5G smartphone sales are expected to grow to over 660 M units in 2022.

Overall, Micron won’t have any shortage of areas for growth for a while. Management is expecting $8.7 B revenue in 3Q 22, and I don’t think Micron will have any struggle achieving this number.

Revenue by Business Unit (Micron’s Investor Relations) Memory and Storage Demand by Segment (Micron’s Investor Relations)

Industry Leading Technology And Efficiency

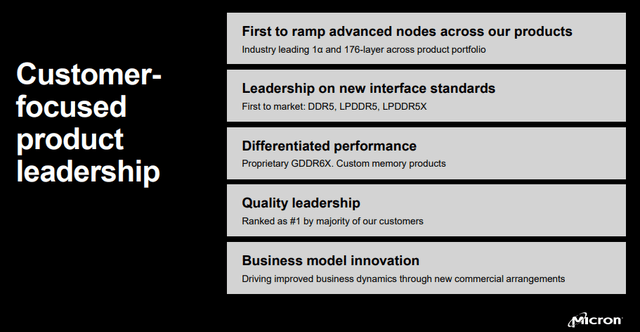

Micron is known for industry leading technology and high-quality products. The majority of their customers rank Micron’s semiconductors as the number 1. Micron’s GDDR6X, launched with NVIDIA on GeForce RTX 3090 and GeForce RTX 3080, brought gaming and AI performance to the next level. Also, their current major products (DRAM 1-α and 176-layer NAND) are the industry’s most advanced products in volume production, and their next generation

products (DRAM 1-β and 232-layer NAND) are expected to lead the market as well.

Additionally, Micron has accumulated many decades of cumulative process knowhow, and they know how to manufacture their products efficiently. Their DRAM 1-α and 176-layer NAND achieve excellent yields, allowing the company to lower costs and improve margins. Their leadership in quality is truly the main differentiator for Micron.

Micron’s Leadership Position (Micron’s Investor Relations)

Strong Financial Position And Investment

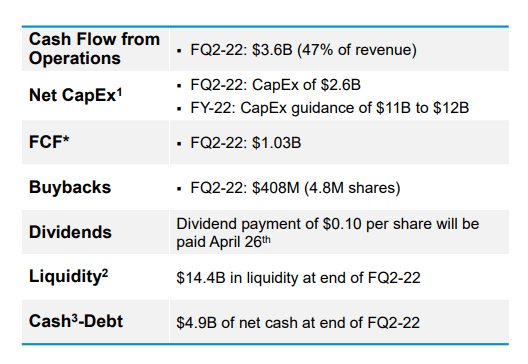

Thanks to the strong revenue growth and exceptional profit margin, Micron has amazing operating cash flow. They generated $3.6 B of operating cash flow from 2Q 2022 alone. Strong cash generating ability and savvy capital allocation put Micron in an exceptional financial position. They have over $10 B in cash with high liquidity (current ratio of 3.11x and quick ratio of 2.24x).

Using this solid financial position, management is planning to spend $150 B in Capex and R&D over the next decade. This aggressive investment in growth and improvements is likely to further strengthen their economic moat and ensure that they can meet the ever-increasing demand for their products. Micron still has plenty of runway for growth ahead.

Micron’s Financial Position (Micron’s Investor Relations)

Intrinsic Value Estimation

I used a DCF model to estimate the intrinsic value of Micron. For the estimation, I utilized free cash flow ($3.7 B) and current WACC of 8.0% as the discount rate. For the base case, I assumed cash flow growth of 20% (average revenue growth of the past 5 years) for the next 5 years and zero growth afterwards (zero terminal growth). For the bullish and very bullish cases, I assumed cash flow growth of 21% and 23%, respectively, for the next 5 years and zero growth afterwards.

The estimation revealed that the current stock price represents 15-20% upside. Given their leadership position, superior technology, and strong financials, I expect Micron to continue to grow and achieve this upside.

|

Price Target |

Upside |

|

|

Base Case |

$75.24 |

13% |

|

Bullish Case |

$78.04 |

17% |

|

Very Bullish Case |

$83.92 |

26% |

The assumptions and data used for the price target estimation are summarized below:

- WACC: 8.0%

- Cash Flow Growth Rate: 20% (Base Case), 21% (Bullish Case), 23% (Very Bullish Case)

- Current Free Cash Flow: $3.7 B

- Current Stock Price: $66.62 (05/24/2022)

- Tax rate: 20%

Cappuccino Stock Rating

Here is the summary of Cappuccino Stock Rating.

| Weighting | MU | |

| Economic Moat Strength | 30% | 4 |

| Financial Strength | 30% | 5 |

| Growth Rate vs. Sector | 15% | 4 |

| Margin of Safety | 15% | 4 |

| Sector Outlook | 10% | 5 |

| Overall | 4.4 |

Economic Moat Strength (4/5)

Micron has a substantial economic moat. They are technologically superior, and their process is more efficient (higher yield) than competitors. This competitive edge results in strong profitability with substantial operating cash flow. However, the semiconductor sector is an ultra-competitive field with formidable foes (e.g., Samsung and SK). Also, due to the short product life cycle, a small misstep can result in large loss of market share. Therefore, 4 would be appropriate for Micron.

Financial Strength (5/5)

Micron is financially very strong. They have over $10 B in cash (-$4.17 B, net debt position) with high liquidity (3.11x current ratio and 2.24x quick ratio). Their financial strength is far ahead of competitors, which is not surprising given their ability to generate operating cash. Easy 5 in this category.

Growth Rate (4/5)

Micron’s revenue growth has been substantially above the sector average. YoY revenue growth was 32% for Micron against 20% for the sector median. Their operating cash flow and profit have been growing accordingly as well. Given their size, this is an amazing growth rate. However, it’s hard to justify a 5 here because there are smaller and earlier phase companies with 50-60% revenue growth YoY.

Margin of Safety (4/5)

The intrinsic value of Micron is about 15-20% higher than the current stock price. Given their strong cash flow, financial position, and market leading position, I believe their stock price will recover nicely. Their margin of safety is not as high as other beaten down tech stocks, but it still presents an adequate opportunity for investors.

Sector Outlook (5/5)

Semiconductors will be one of the fastest growing sectors for the next several years. Growth in all those appliances, electronic devices, and data centers will be amazing. Also, electric vehicles are like a “data center on wheels.” Micron will enjoy large tailwinds from these overall trends.

Risk

The semiconductor business is notoriously cyclical and ultra-competitive. The revenue growth has seen a large upswing in the past couple of years, but many semiconductor manufacturing sites are scheduled to open in the next couple of years (Samsung, Intel, TSMC, etc.). These may apply downward price pressure, causing Micron’s revenue growth and margin to suffer in the short term.

There was some recent news about U.S. officials considering banning semiconductor chip equipment to China. If the ban goes into effect, the trade tension between the U.S. and China could escalate. This would have a negative impact across the overall sector and on Micron. Therefore, an investor should monitor this news.

Conclusion

Micron has been a great investment option. With the increasing demand for semiconductors and Micron’s market leading technology, I expect they will remain just as strong of an investment option for the future as well. The cyclicality of the semiconductor business and supply chain disruption may bring challenges, but they have the cash flow and market position to handle it. I expect 15-20% return in the long run.